China Devalues Yuan as Stocks Crash

We Told You So

As much as we truly hate saying it, as well as, warning folks, time and time again, for years and months on end - about the huge, looming Chinese meltdown- it was as if we are just talking to ourselves. Nobody appeared to listen.

OK - now are you going to lend us your ears...

Why Singapore's Economy Is Heading For An Iceland-Style Meltdown

Well, the global financial system has basically been teetering since 2008, AND "insiders" have been expecting the dark forces to arrive any day. Looks like the first stop along the way may be Singapore?

Mervyn King: The Eurozone is Doomed

Whatever boneheads thought that supra-constitutions were better for economic stability or governing anything had more than a few loose marbles. Basically, such stupidity undermines both free enterprise and democracy , thereby destroying the fabric, inspiration and motivation of a society while concurrently leading to oppressive states that garner Soviet-style sluggishness and inefficiencies.

Now, if you recall the Soviet system fell apart just for the reasons mentioned above - meaning that it was a perfect time for the Eurozone to copy their failed ideology ( so who needs a book to figure out common sense issues? - More dumb!)

Repeat after FFI folks, "Tear Down Those Walls Mr Gorbachev"

Arab States Face $94 Billion Debt Crunch on Oil Slump, HSBC Says

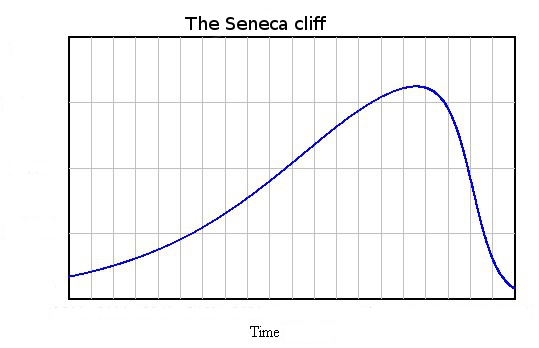

How many businesses can withstand a drop in revenues of 50% or more and expect to survive? Few, if any! With oil prices being down by that percentage, expect many of the resource based countries to start defaulting on their debt and thereby crashing the global banking system along with the stock markets. It will cascade!

It was all a house of cards built on an exuberant credit bonanza fueled by unprecedented low loan rates that was doomed from the start. Now here comes the payback - and it won't be pretty.

All things revert to the mean - that's the first law of common sense, just ask Soros!